Parcel

Receive a parcel from abroad

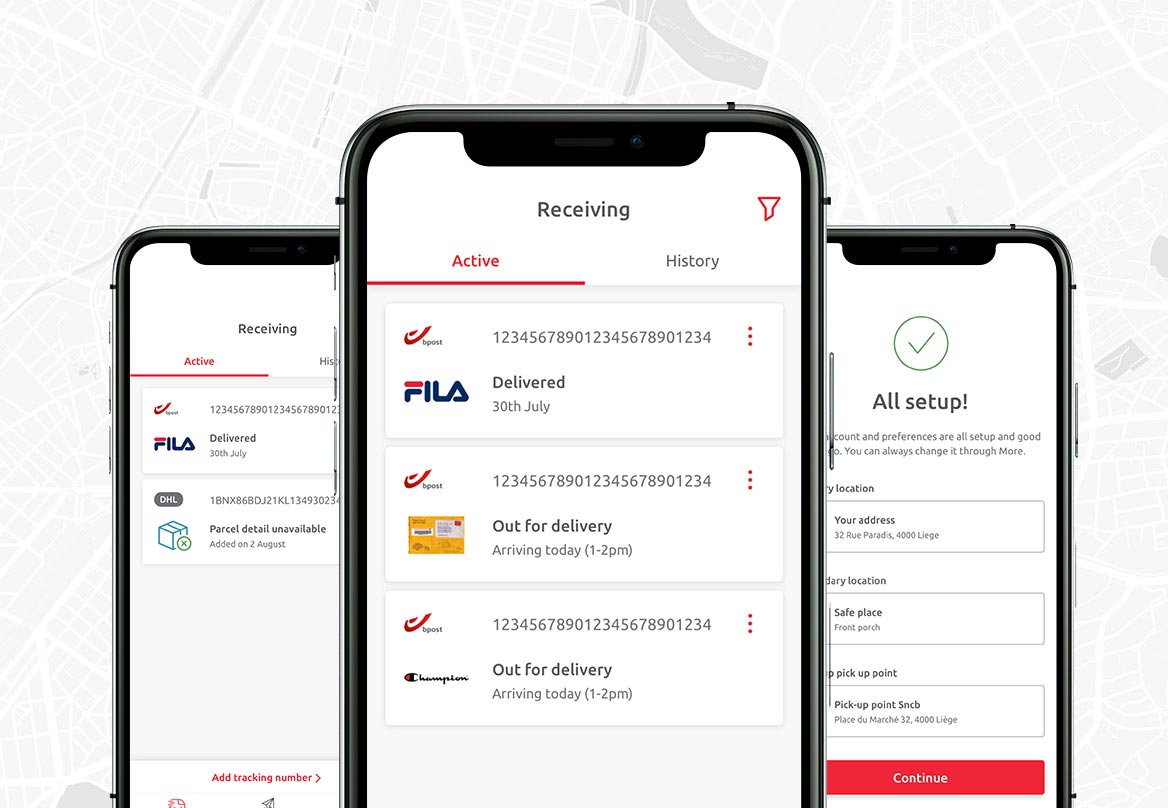

Download the My bpost app

And manage all your parcels in one handy app

- Follow all your parcels, including those from other postal services

- Set your delivery preferences

- Dive into your letterbox digitally, send parcels & registered mail, and much more

Not home when your foreign parcel is delivered?

Perhaps you still have one of these questions

When a parcel from outside the European Union arrives in Belgium, it is handed over to the bpost customs clearance service, which prepares it for customs clearance. The process is as follows:

1. Clearance of the parcel

If VAT on your parcel has been paid in advance via the webshop, it will be immediately handed over to customs. If not, it will be cleared through customs first. This includes the calculation of customs duties, VAT and any other fees (like anti-dumping duties and environmental duties). As of July 1, 2021, this applies to all shipments, regardless of their value. More information about the customs rules.

As the recipient, you must pay these import costs in advance via the My bpost app or via Track & Trace. You will receive an email, text message or letter with a payment invitation.

2. Security check

Customs performs a security check on all goods arriving in Belgium from outside the European Union. Customs checks whether the goods can be imported to Belgium. If not (e.g. counterfeit goods, weapons or medicine), customs blocks your parcel.

If your shipment is subject to inspection, please allow for an additional 3 to 7 days.

3. Delivery of the parcel

As soon as customs clears the goods, bpost takes care of delivery. Bear in mind that the whole process can take several days. You can track the status of your parcel via Track & Trace. You will be notified if any further formalities need to be completed.

Once the import costs are calculated, you will find a detailed overview of the costs in Track & Trace and in the My bpost app. You will receive a request to pay the import costs. This can be by email, text message or notification if you have installed the My bpost app. If the sender did not send us the data digitally, you will receive a letter with a payment request.

You can make the payment securely via the My bpost app or by signing in via Track & Trace. You can pay via Bancontact, Mastercard, Visa or mobile banking. Also from abroad. PayPal and bank transfers are not possible.

Exceptionally, you can pay your import costs in another way.

Watch out for fake messages and phishing; bpost will never ask you to pay by bank transfer or provide a bank account number. Read all about it on our phishing page.

This depends on where your parcel was sent.

My parcel comes from inside the European Union

Customs is authorised to check all shipments from inside the European Union. That usually involves suspect shipments from EU member states and shipments with excisable goods inside the European Community. Your parcel doesn't usually experience extra delays.

My parcel comes from outside the European Union

These parcels undergo an import procedure by default. The handling period depends on the following two factors:

- whether your parcel has enough information, such as the value and nature of the goods. (If that is not the case, you will receive a letter a few days later. In that case, the handling period is extended until you send the additional information). The customs clearance service of bpost checks whether VAT, customs fees or other duties have to be paid on your parcel.

- whether customs or other official authorities have to check your parcel. That is the case for medicine, plants and food, weapons, suspected counterfeit goods, etc. You can follow the status of your parcel online with Track & Trace and the My bpost app.

In certain cases, a parcel received from outside the EU can be exempt from import costs. We then speak of a gift. Your parcel must meet the following conditions:

- The sender is a private person (e.g. family member, friend, acquaintance). A parcel from an online shop is never considered a gift (even if it says gift on the package).

- The contents of the parcel are for personal use. If the parcel contains alcoholic products, tea, coffee, perfume, eau de toilette, tobacco or tobacco products, the excise duty-free quantity is not exceeded. More detailed information can be found in the related Royal Decree.

- The value of the shipment does not exceed €45. If the total value of your shipment exceeds €45 and consists of several goods, you can get a partial exemption for the goods that (on their own or together) are worth max €45. (See table)

- As the recipient, you have not paid for the parcel.

It is important that the sender declares the shipment as a gift on the customs form (CN22 or CN23).

Please note: if your parcel meets all the requirements and you are still charged import costs, you can dispute these costs and apply for an exemption.

My gift consists of: | Maximum exemption | |

|---|---|---|

Example 1 | 1 sweater - 47 € | 0 € |

Example 2 | 2 jackets - 300 € | 45 € |

Example 3 | 1 hat - 20 € | 40 € |

bpost is charging the following fees for customs formalities or administrative fees if the VAT was not paid in the online shop:

- €0 for private shipments with a value of up to €45. In this case, the sender has to prove that the shipment is a gift. (Please note: alcoholic products, perfume, toilet water, tobacco and tobacco products are subject to fees, even if they are gifts).

- €21,5 for completing customs formalities for non-exempt shipments with a value of maximum €150.

- €40 for completing customs formalities for non-exempt shipments with a value of more than €150.

- €60 for phytosanitary inspections of plants and plant products.

- €85 for a regularisation dossier.