New import charges on all shipments

Online shopping outside the EU? Go ahead!

On 1 July, the European Union introduced new customs rules for online purchases from outside the EU. We assume that most major non-European webshops are compliant with the new EU regulations by now. So you can continue shopping there with peace of mind, without the risk of extra costs. And you can easily check: if your shopping basket shows that VAT is included, then it’s safe!

Shop in a registered webshop

Non-European webshops can register with the EU to settle VAT and import charges in advance. Make as many of your purchases as possible from these registered webshops. That way, not only is the process smoother but you also pay less.

Tip: registered webshops will always state in your shopping basket whether VAT is included.

Suppose you purchased a new smartphone case

More examples can be found on the website of FPS Finance.

Suppose you purchased a new smartphone case

Why choose a registered webshop?

All benefits in a nutshell:

Good to know:

VAT and import charges are always due on shipments with a value in excess of €150.

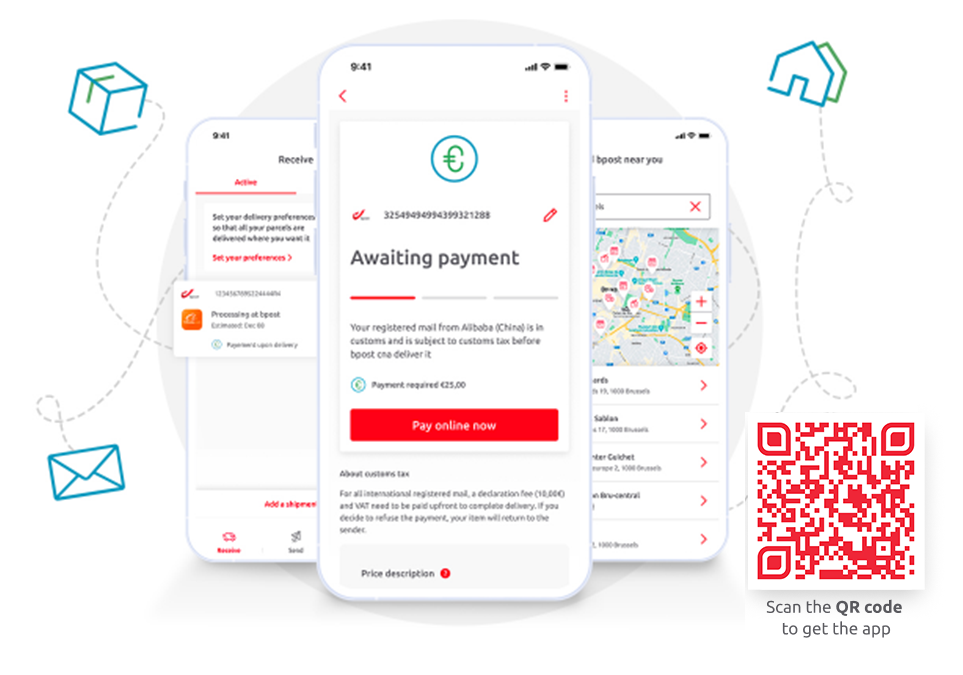

VAT and import charges are due anyway? Pay fast and safe with the My bpost app or Track & Trace!

The webshop didn’t include the VAT and import charges at sale? Easily pay the VAT and import charges online via the My bpost app or Track & Trace. You will always be asked to pay prior to delivery of your shipment.

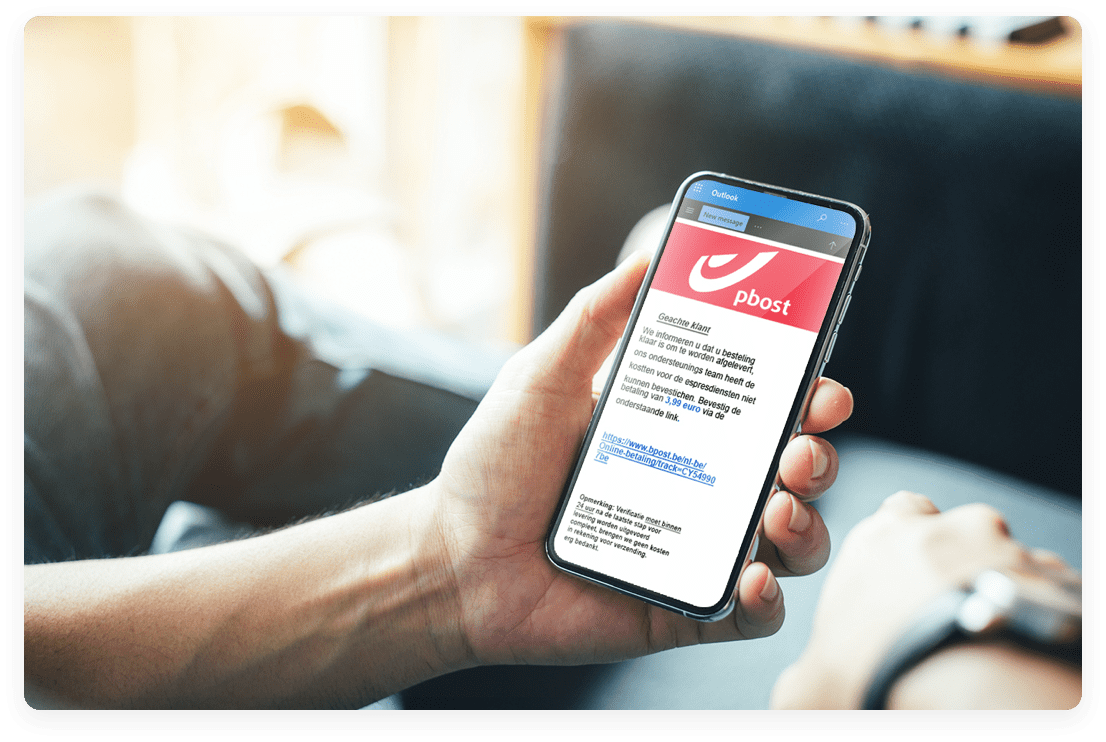

Don’t fall for fake emails from bpost

Optimise your protection against phishing with the My bpost app! Did you receive an email with payment instructions?

Track, receive, send and pay. All in a single app!

- Suivez tous vos envois, y compris ceux des autres livreurs.

- Faites-nous savoir où livrer votre envoi en votre absence.

- Créez rapidement une étiquette d’envoi si vous souhaitez expédier votre colis vous-même.

- Payez les frais d’importation en toute sécurité pour les envois provenant de l’extérieur de l’UE.

Perhaps you still have one of these questions

The costs to import goods from outside the EU consist of 3 parts:

- VAT

For all goods coming from outside the EU, a percentage of VAT on the value of the goods must be paid. This percentage varies between 6% (books) and 21% (electronic products). Please note that the VAT due for importing goods is calculated not only on the price you paid to the seller but also on certain additional costs such as shipping costs and the administrative fee charged by bpost for completing customs formalities.

- Custom duties

For certain categories of goods you have to pay customs duties. These are also represented by a percentage. For some goods (e.g. jeans), you pay up to 12% duty. For other goods you do not pay duty (e.g. books).

Customs formalities or administrative fees

The bpost customs clearance service charges administrative fees for the costs incurred during the import procedure if:

- the VAT was not paid in advance in a registered online shop (Import One-Stop Shop or IOSS)

- the value of the goods is more than €150

These costs include:

- the calculation of import taxes

- transferring the taxes to the government

- requesting additional missing information (e.g. licenses or invoices)

- storage costs

From 1st January 2026, bpost will charge the following fees for customs formalities:

0 euro | for private shipments with a value of up to €45. In this case, the sender has to prove that the shipment is a gift. (Please note: alcoholic products, perfume, toilet water, tobacco and tobacco products are subject to fees, even if they are gifts). |

21.5 euros | for customs formalities regarding non-exempted items with a maximum value of 150 euros. |

40 euros | for customs formalities regarding non-exempted items with a value over 150 euros. |

A numerical example

Purchase of a T-shirt on a website in the United States of America

- Value incl. shipping costs: 38 euros

- Cost of customs formalities: 21.5 euros

- Import duties: 0 euros (because < 150 euros)

- Applicable VAT rate: 21%

- Measure of charge for VAT: 38 euros + 21.5 euros = 59.5 euros

- VAT amount due: 59.5 * 21% = 12.50 euros

- Payable to bpost: 34 euros (VAT: 12.50 euros + customs formalities: 21.5 euros)

- Total cost of your purchase: 38 euros (T-shirt) + 21.5 euros (customs formalities) + 12.50 euros (VAT) = 72 euros

More information on the applicable tax rates and on how to calculate the import costs.

TIP! Are you shopping in a non-EU webshop and want to avoid extra costs? If your shopping basket states that VAT is included, then you’re safe! You won’t have to pay any costs later.

(1) To avoid double taxation, the import fees owed to bpost do not include VAT (exempt). You already pay VAT on these fees when you import your goods, just as you do on the delivery charges.

Non-European webshops can register with the EU to enable the payment of VAT and import costs in advance in their webshop. Most major webshops such as AliExpress, E-bay and Wish have already registered.

You can easily recognise a registered webshop: if your shopping basket indicates that VAT is included, then you’re safe! That way you avoid:

- paying unwanted import charges and customs clearance fees;

- paying VAT on customs clearance fees;

- waiting longer to receive your shipment.

NB: for goods with a value above €150, you will always have to pay import charges as these are not paid by the webshop.

Since 1 July 2021, new customs rules apply and VAT must be paid on all shipments from outside the EU. If no VAT is stated at the point of purchase, additional import charges will be applied.

To avoid additional import charges and increased VAT (as you pay VAT on customs clearance fees), we recommend that you order:

- from a registered webshop outside the EU. These shops settle the VAT on your purchase in advance so you don’t pay import charges and your shipment is processed more quickly. More info on how to recognise an IOSS registered webshop.

- from a webshop that ships from within Belgium or the European Union. Remember the United Kingdom is no longer part of the European Union.

Please note: For goods with a value above €150, you will always have to pay customs clearance fees. In this case, the import charges cannot be paid via the webshop.

My shipment is coming from within the EU

- Some regions of the EU are also subject to customs duties and VAT because they are not part of the EU customs territory, even if they belong to the geographical territory of the EU (e.g. the Canary Islands).

My shipment is coming from outside the EU

In accordance with European customs legislation and VAT regulations, you must pay taxes (customs duties, VAT, excise duty and administrative processing charges) on all commercial shipments from outside the EU. Your shipment will only be delivered if you pay these charges within 14 days of receiving the payment notification. Once the import fees are paid, your shipment will be presented to customs.

- If your shipment is a gift, you may be exempt from import charges in certain cases.

- If you order from a registered online shop (Import One-Stop Shop or IOSS), which pays the VAT in advance, you don’t have to pay any additional taxes, customs duties or administrative fees to the customs clearance service of bpost. You can easily recognise a recognised webshop: if your shopping basket states that VAT is included, you are safe!

- Fees for customs formalities are administrative charges that are charged by the bpost customs clearance service for:

- determining the contents and value of the parcel

- contacting the addressee in case the contents, value and customs clearance information of the parcel do not correspond or are incomplete;

- creating the required customs declaration;

- storage and warehousing of the shipment during the collection of customs duties.

- Fees for customs formalities are administrative charges that are charged by the bpost customs clearance service for:

Please note: shipments with a value above €150 are always subject to customs duties and administrative processing costs.