bpaid

Pay securely worldwide without a credit card

- Pay securely online and offline

- Not linked to a bank account

- For everyone in Belgium who’s over 18

- Costs just € 18 per year

Shopping with peace of mind

Online or in your favourite stores.

Get a bpaid card and hit the sales. You can track your transactions and balance in the bpaid app, available on Google Play and App Store.

How it works in four easy steps

Why choose bpaid over a credit card?

Limited risk online

Don’t trust a website or worried about phishing? bpaid limits your exposure to the amount you have loaded on the card.

Accepted worldwide

bpaid is a prepaid Mastercard that is accepted around the globe. Online and offline, just like a credit card.

Set your own budget

When using a credit card, there’s always a risk to overspend. When using a prepaid card like bpaid, you set your own budget, which cannot be exceeded.

Maybe you still have questions?

If you see the cancelled purchase in “Pending transaction” on the My bpaid portal, it means that the merchant has put a hold on the amount. That gives the merchant peace of mind that it can claim some of the costs in the event of cancellation. Examples are when you book a hotel room or hire a car. The hold is automatically lifted within 30 days. The amount becomes available again as soon as the hold is lifted.

You can ask for the hold to be lifted if this is not done within 30 days. To do so, follow the steps below.

- Ask the merchant to send you the following:

- An authorization code (comprising five or six digits or letters) showing that funds have been transferred from an account)

- Confirmation (in an email, for example) that the merchant agrees to release the hold.

- Once you have received the authorization code and confirmation, fill out our online form (you cannot do this without the authorization code, the confirmation and your card number). You can find this form in the bpaid app and on the My bpaid website.

You cannot transfer funds from your bpaid card to your bank account.

If you wish to cancel your bpaid card and claim the unused funds on the card, visit a Post Office. You will have to present your ID card and your bpaid card. The unused funds on the card will be transferred to your account along with a proportional part of the annual administration costs.

Reloading your card usually takes three business days, or five in exceptional circumstances. There are two reasons why you may not see your funds on your card after five business days:

- You did not enter the 12-digit ID code on the back of your card (100/xxxx/xxxxx) in the structured reference field.

- You have reached your reload limit (minimum €10; maximum €2,500 per reload and €8,000 per year)

The amount will be returned to your amount within 10 business days.

See the steps for activating Mastercard Identity Check on your bpaid card in the bpaid app. Or check out the instructional video below the answer.

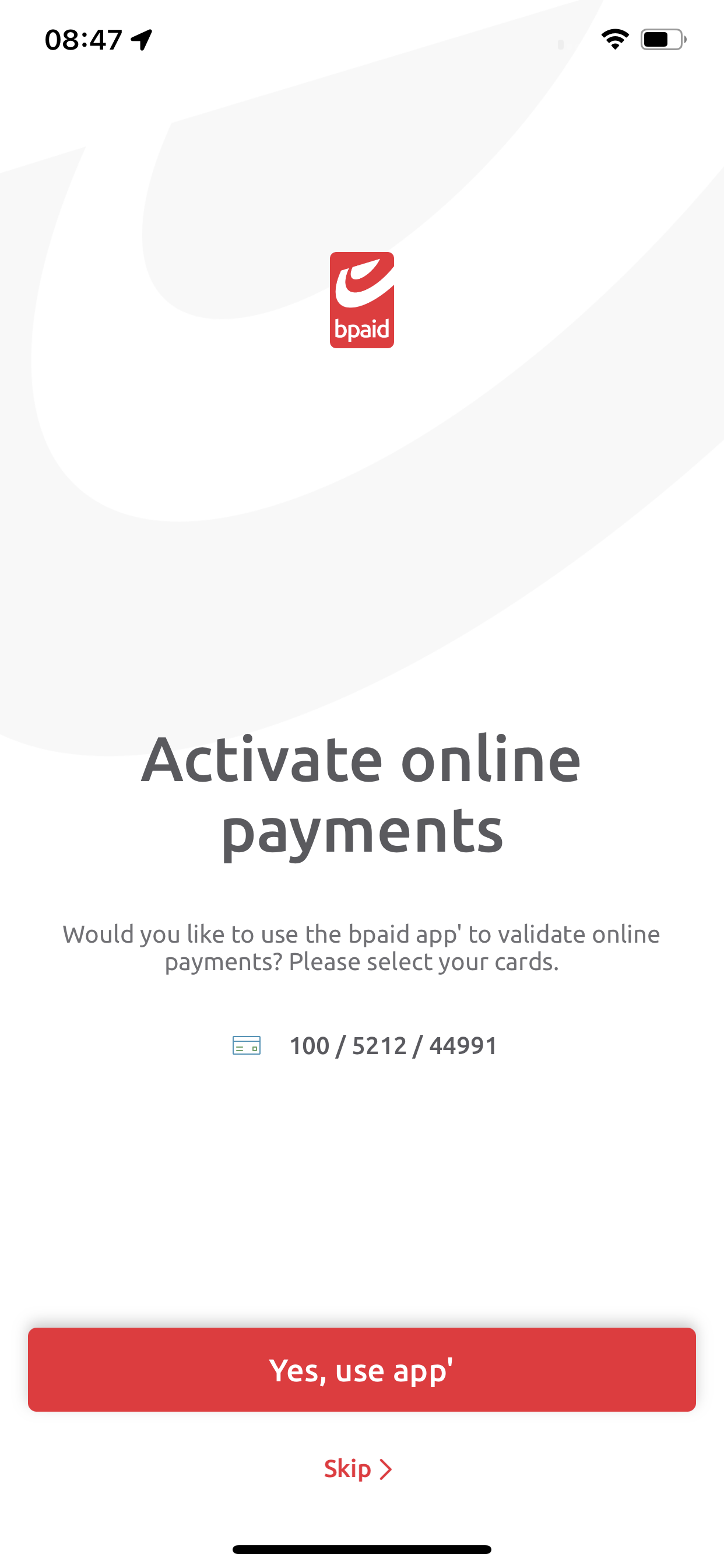

1.

Log in to your bpaid account in the app.

If your card is not secure, the app will ask you whether you wish to activate your card for online payments.

2.

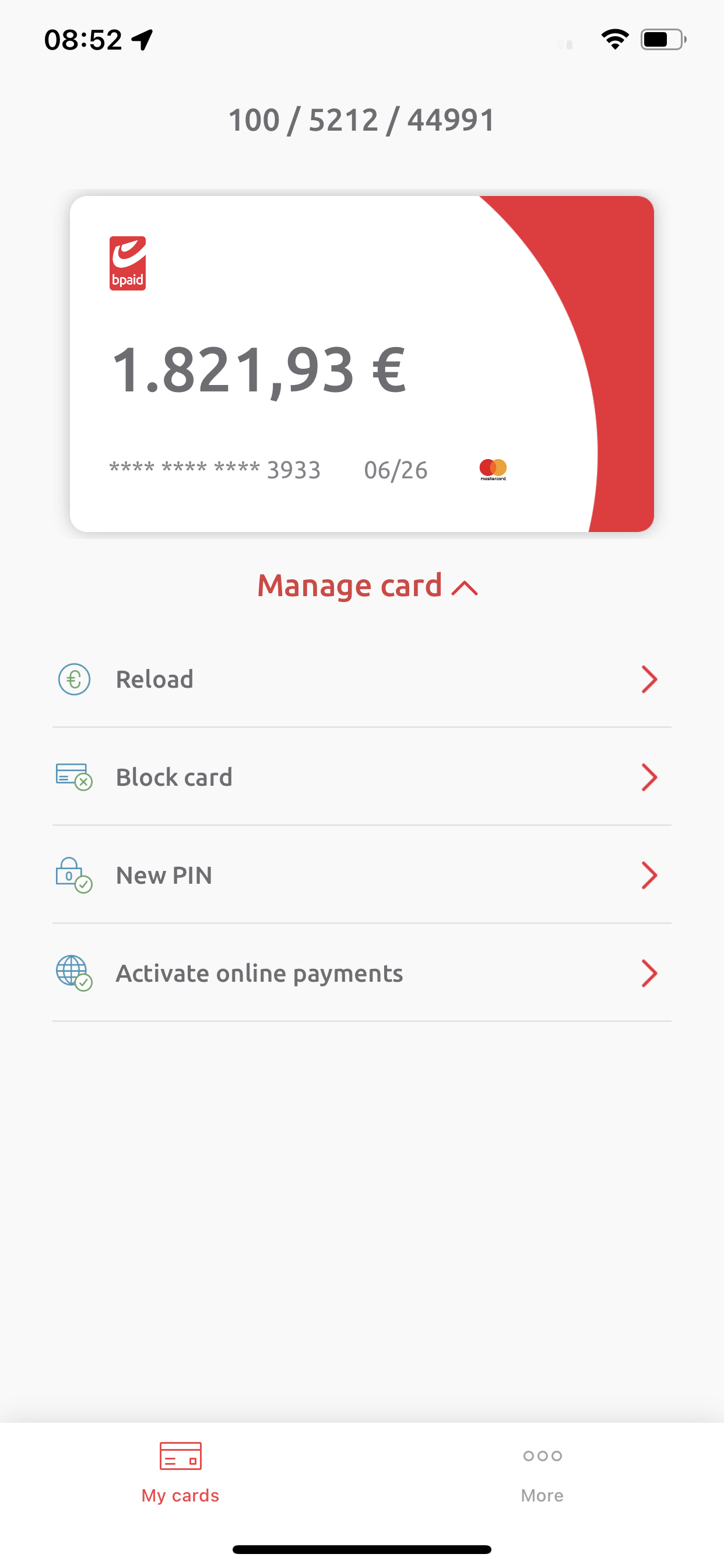

You can also do this yourself in “Manage card” > “Activate online payments”.

3.

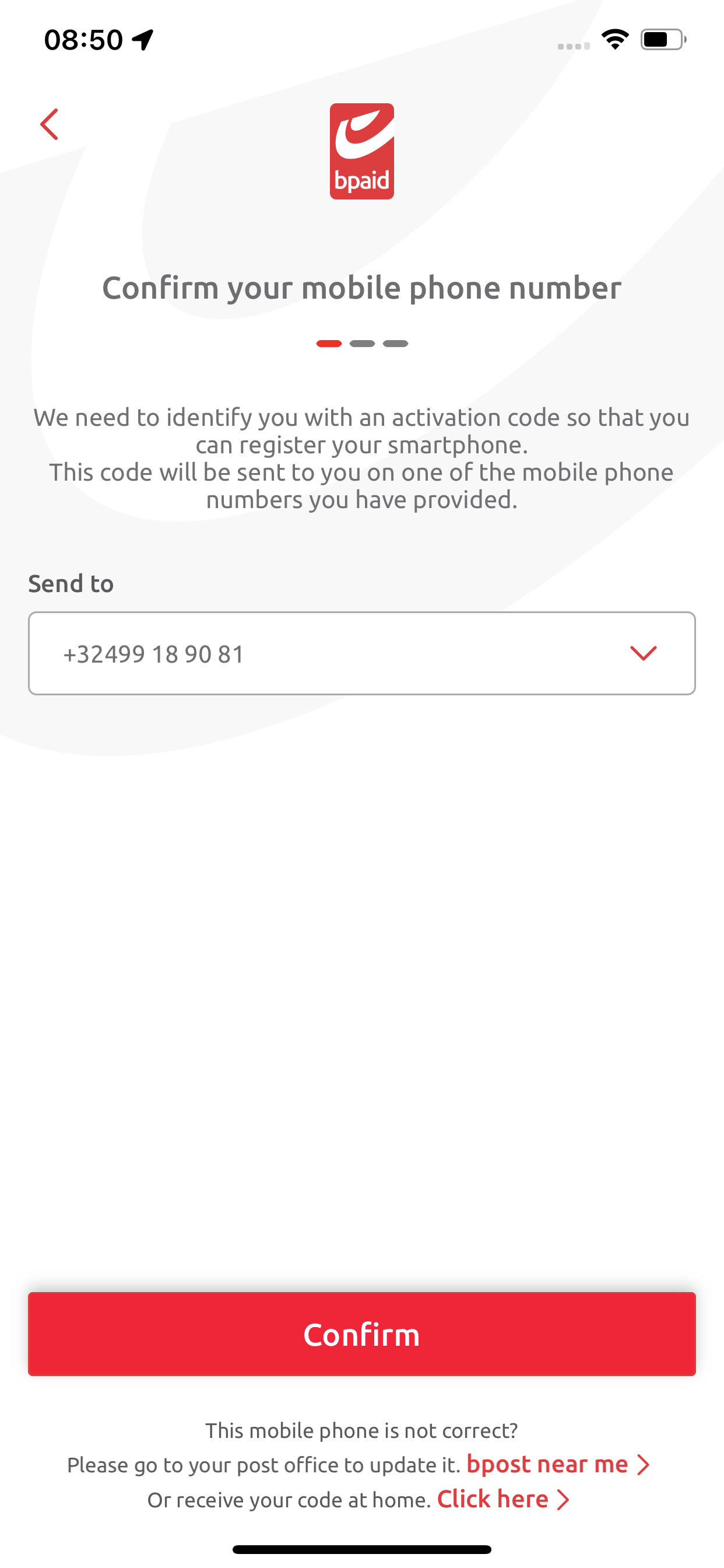

If you have already linked a mobile phone number to your card, you can continue. If not, follow the instructions for registering a mobile phone number at a Post Office.

4.

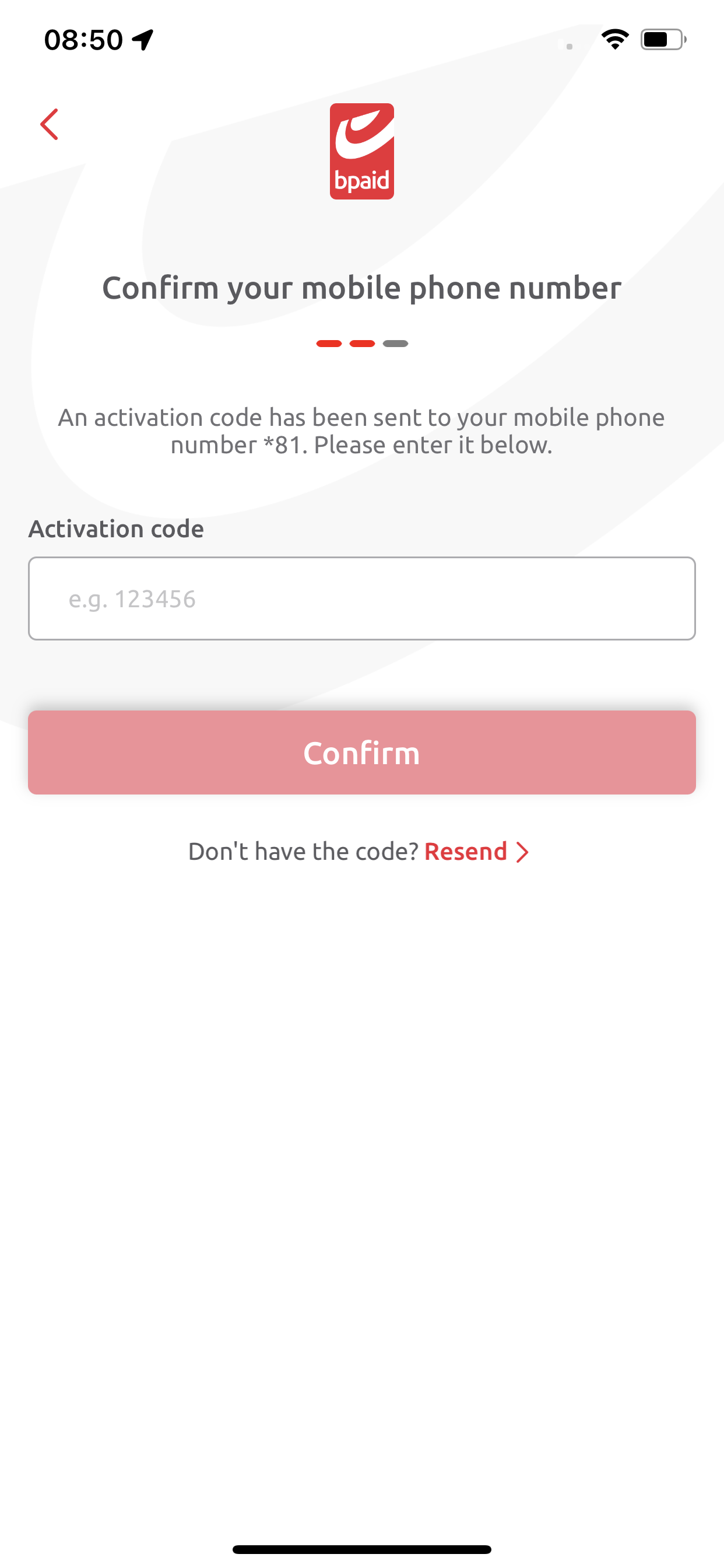

You will receive an activation code by text message on that number.

Enter this six-digit code when requested in the app.

5.

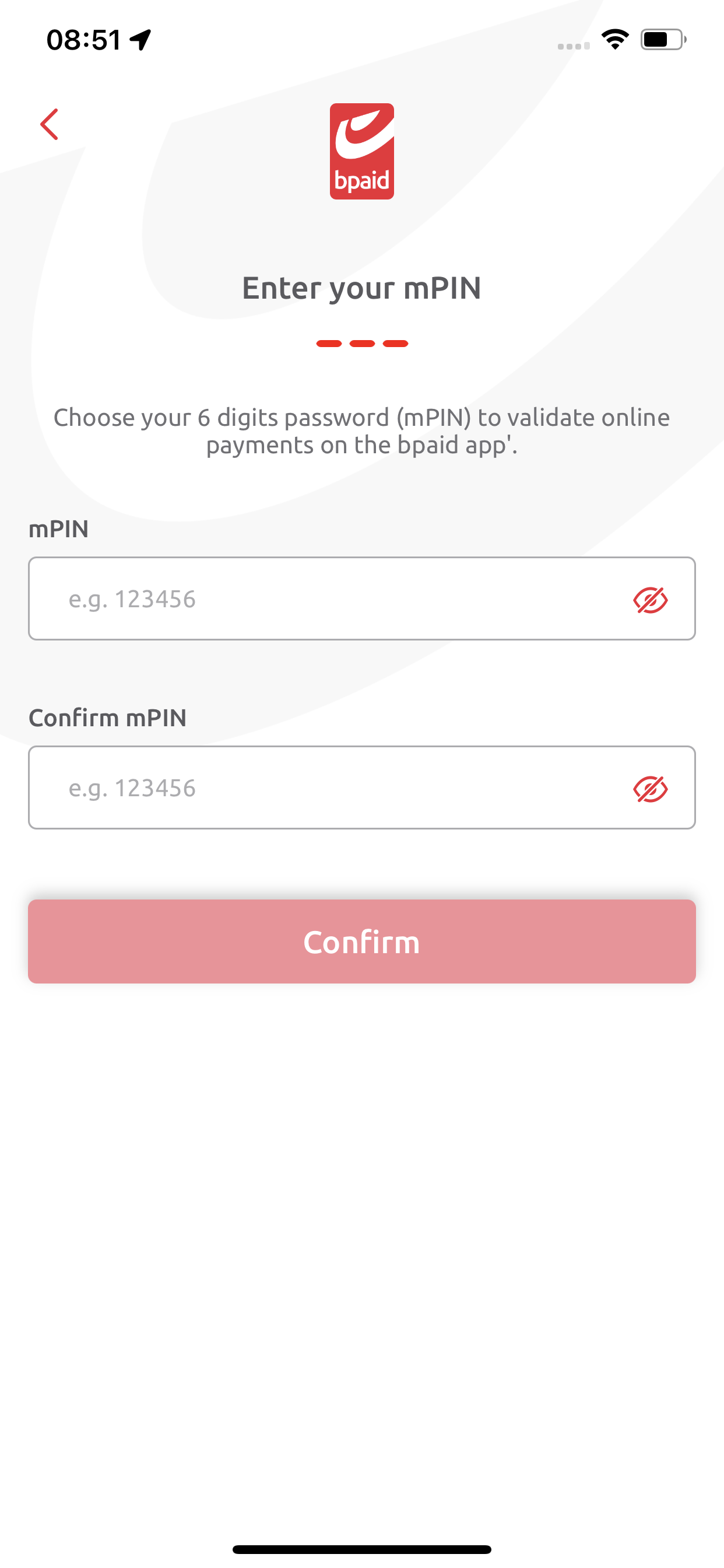

The next step is setting your Mastercard Identity Check mPIN. This is a six-digit code you use for online transactions protected with Mastercard Identity Check. Depending on your smartphone, you can also use Face ID of fingerprint recognition.

6.

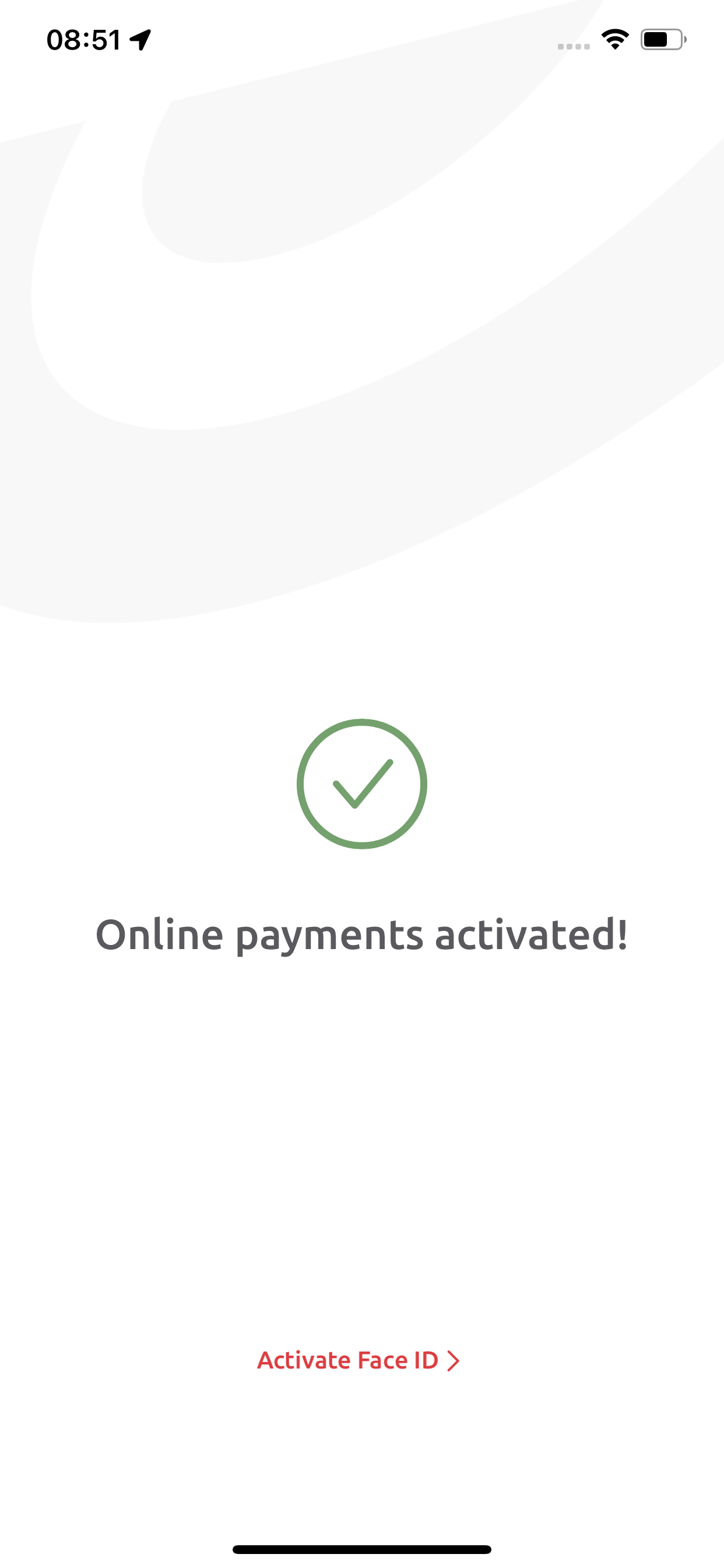

In the event of an online transaction you will be asked to authorize your payment in the bpaid app by means of your mPIN, Face ID or fingerprint recognition.

7.

After confirmation the “Activate online payments” option will no longer be visible in the “Manage card” menu.